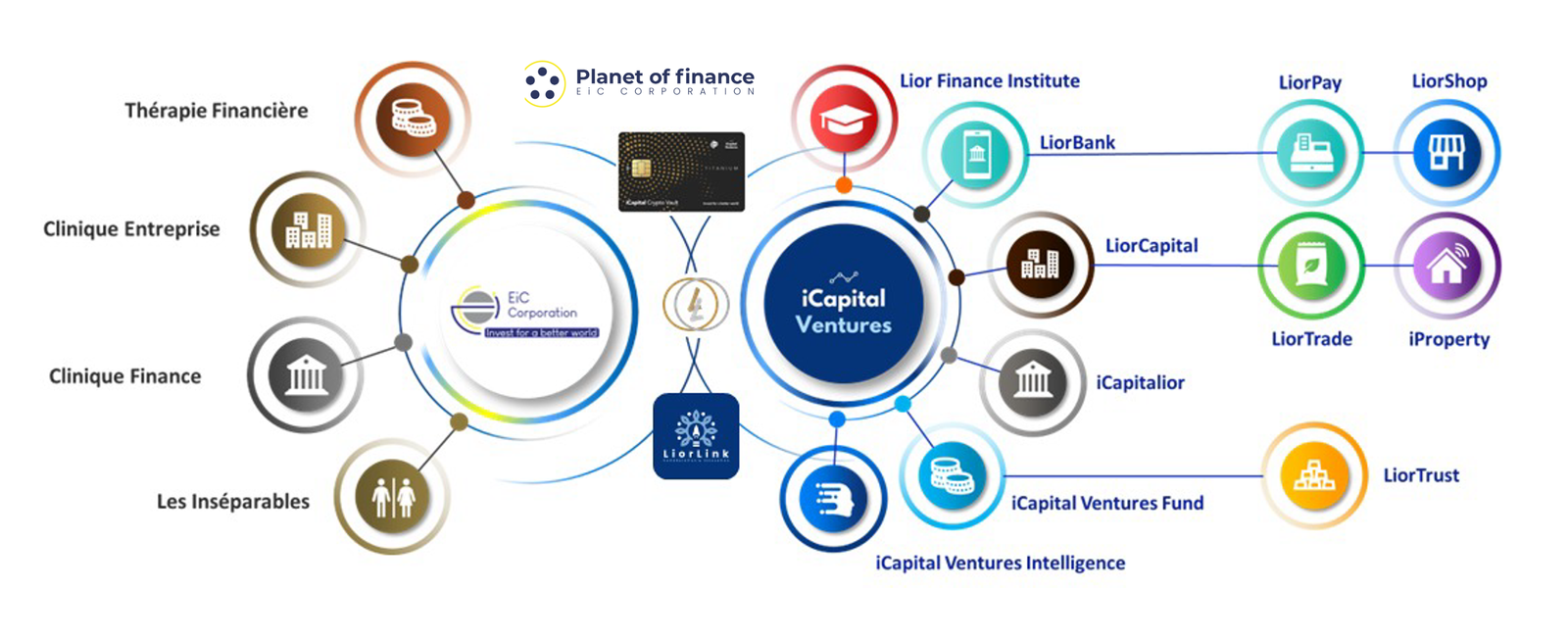

Ecosystem

LiorS/G

The LiorS/G token is a digital asset based on the Ethereum blockchain (ERC-20), with utility functions spanning membership, service access, governance, payment, and unit of valuation.

Democratizing Finance for All

LiorS/G powers economic-financial exchanges and project financing via a decentralized infrastructure and a vision of financial education for the emergence of genuine economic agents. Participation across platforms is rewarded in LiorS, with exclusive offers and benefits unlocked by holding thresholds.

Where LiorS/G is Used

Recognition

-

FORBES

Achille AGBE ranked 3rd — Top 30 under 30 African Entrepreneurs

-

PRIX NATIONAL D’EXCELLENCE

Ivorian Excellence Award 2014 — 3rd Prize for Best ICT Development Initiative

-

World Federation of Investors

EIC Corporation is an active member of the WFIC and the Global Business Angels Network (GBAN)

-

Rotary Club

Prize of the Champions of Entrepreneurship Spirit

Strategic Perspectives & Roadmap

The development trajectory of LiorS follows a long-term vision, aligned with the growth ambitions of iCapital Ventures and the social and financial impact goals of the EiC Corporation Foundation. It is based on a progressive, secure, and inclusive deployment, organized around four major strategic stages.

Structuring Launch Phase

- Initial listing of LiorS on LCX – Liechtenstein Exchange, a regulated stock exchange with strong technological potential.

- Deployment of the Liorpay API, a universal payment infrastructure integrating the token as a means of inter-platform exchange.

- Adoption and integration campaign through:

- Recruitment & certification program for Associate Partners,

- Expansion of Non-Executive Directors (NED-G25),

- Acceleration of the Qualified Investors & Wealth Management (QI & WM) program.

International Expansion Phase

- Expansion of LiorS to 5 new exchanges, increasing liquidity and international visibility.

- Strengthening institutional adoption: network of family offices, foundations, partner funds, and affiliated incubators.

- Acceleration of certified executive recruitment via international QI & WM cohorts.

- Progressive deployment of iCapital Ventures platforms in French-speaking and English-speaking regions.

Preparation for IPO (Pre-IPO)

- Full listing of LiorS on 10 regulated & decentralized exchanges (generalist & thematic: green finance, Web3, etc.).

- Completion of recruitment for NED-G25 and Associate Partners (target: 4,500 accredited collaborators).

- Strategic preparation for iCapital Ventures’ IPO: external audit, legal consolidation, and regulatory alignment with international standards.

- Launch of a participatory liquidity fund backed by group assets to stabilize the secondary market.

IPO & Operational Maturity

- Official IPO of iCapital Ventures, the first digital investment bank accredited by decentralized governance.

- Distribution of the first generation of social dividends:

- To internal stock-option holders,

- To social organizations & CSR/CRE partners,

- To accredited investors.

- Deployment of the Solidarity Redistribution Fund, financed by group dividends (financial therapy, inclusion, social transformation).

Long-term vision: Position LiorS as the benchmark currency for societal engagement and patrimonial governance in the universe of decentralized private investment banks.

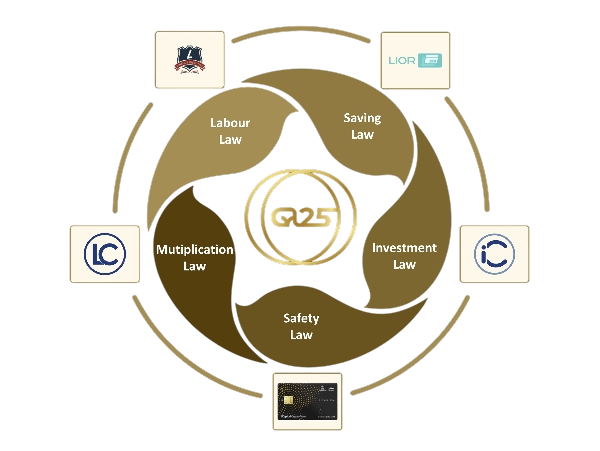

Overview of the Tokens

A concise view of LiorS (utility / governance) and LiorG (stable securitization) within the EIC ecosystem.

- LiorS: membership, payments, governance, valuation.

- LiorG: USDT-collateralized stable, LP mechanics for value transfer.

- Deflationary event: 90% burn ↔ LiorBank shares (2027).

- DAO voting for project selection and ecosystem direction.

Get the Wallet

Use the official wallet to interact with LiorS/G and LiorG across the ecosystem.

Open Wallet on Our Primary Market